Yes, those Bored Ape non-fungible tokens (NFTs) are digital assets that can be protected if a dispute arises on their ownership, a Singapore court appears to have said, after a landmark cause was brought before it this week.

It heard that a Singaporean man, Janesh Rajkumar, had used an NFT he owned from the well-known Bored Ape Yacht Club (BAYC) series as collateral to borrow cryptocurrency.

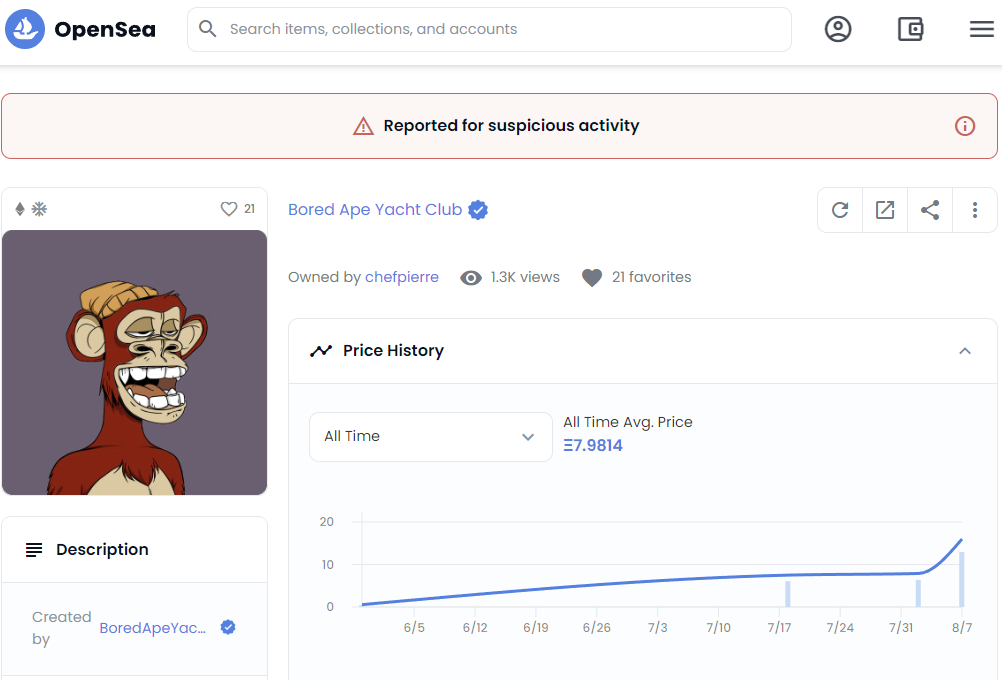

After a dispute with a lender, known only anonymously as chefpierre.eth, the lender was ready to put up the NFT for sale.

According to the the claimant, he was given just hours to repay a loan and when he failed to do so, the lender foreclosed on his cherished BAYC NFT, No. 2162, despite he having no intention to sell it.

It seems the court has agreed with him this time, as it froze the trading of this particular NFT amid the dispute, in what appears to be a worldwide injunction. NFT trading platform OpenSea then stepped in to disable the trading of the NFT in question.

There are still many unknowns about this case, for example, the identity of the lender, whose “in real life” name was not revealed during the case. Would this person come forward to state his case?

More important, of course, is the fact that the Singapore court has recognised an NFT as a digital asset, setting an important precedent for the legal status of such digital creations. They are more than a mere record on a digital ledger, apparently.

At the same time, one question that does get raised here is the decentralisation that blockchain promises to offer. If a court in one country can ask for a digital asset to be frozen from trade globally, how decentralised is this decentralised economy?