IMAGE: Deeptech Times

At ATxSG 2025’s “GenAI beyond the hype” session, industry leaders shared insights on large-scale AI implementation and governance.

Cameron Wall, EY global consulting AI and data competency leader, highlighted EY’s substantial US$1.4 billion investment in AI, including one of the largest Microsoft OpenAI instances globally. However, he also noted that only 13 per cent of organisations have successfully scaled their AI implementations, as per recent Gartner data.

Wall also shared an EY case study with a large Philippine bank’s AI journey, including its “My Buddy” chatbot. This RAG architecture-based system processes 7,000 policies, assisting staff across 12,000 branches and significantly reducing client wait times from hours to seconds.

To drive AI adoption across departments, EY implemented a 100-day delivery cycle and trained banking staff to get them comfortable using AI in their work. “We had executive support. The CEO said nobody would lose their job in the bank through AI, which got the business on board,” said Wall. “We had a 100-day calendar day delivery cycle, and so we’re constantly delivering to the business. Constant communications is key, and I think making people at ease helps with the AI adoption as well.”

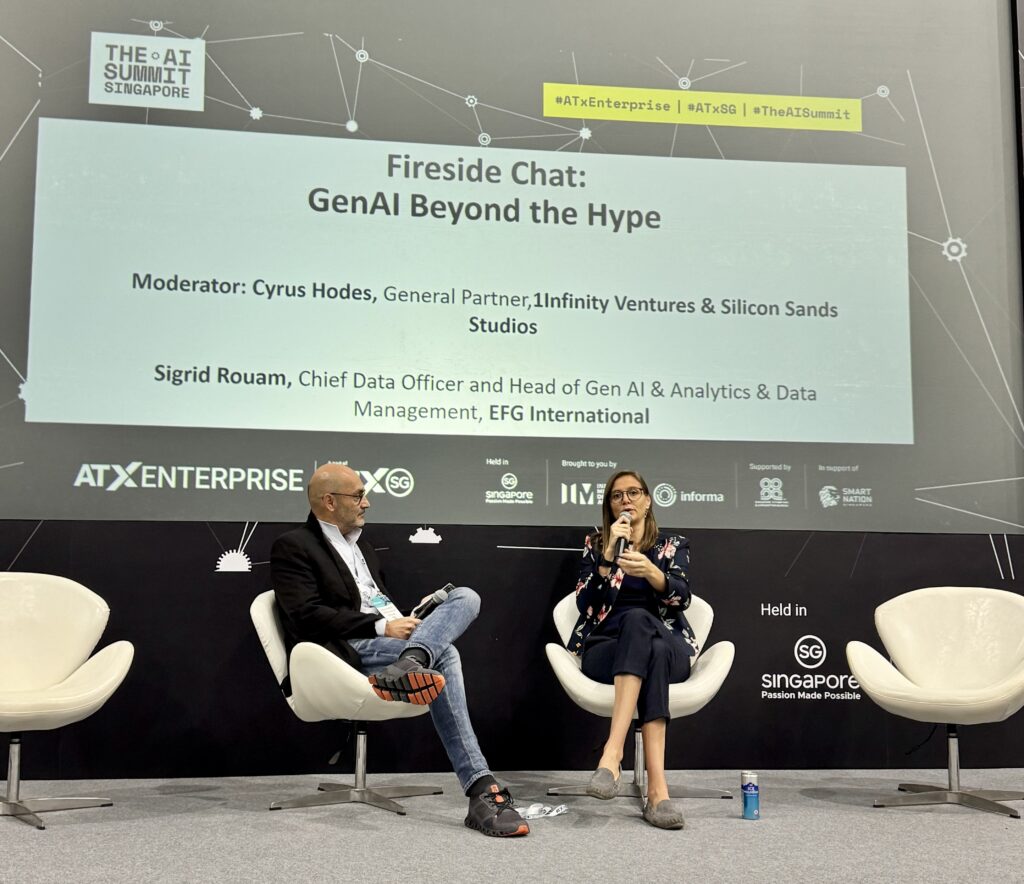

Dr. Sigrid Rouam, EFG International’s chief data officer, showcased its use of GenAI for compliance automation, fraud detection and KYC processes. EFG’s internal ChatGPT, primarily used by the investment solutions team, reduces the back-office process and also helps the bank’s relationship managers position relevant products and services to its clients.

IMAGE: Deeptech Times

To address risks such as hallucinations and deep fakes, the bank balances cloud-based and on-premise models, adhering to, for instance, the Fairness, Ethics, Accountability and Transparency (FEAT) in the Use of Artificial Intelligence framework.

“We see different types of risks depending on the type of AI. We can use things like FEAT, which is the framework that MAS released a few years ago. So, this is very traditional, looking at AI governance. For use cases specific to GenAI, with new risks around hallucination, deepfakes, IP right infringement and so on, we manage tier risks from low to high, adding legal risk management for third party products.”

Dr. Chua Shen Hwee, Energy Market Authority’s (EMA) chief data officer, shared how they processed an impressive 400 internal documents for AI bot use using another machine-learning approach to reconfigure “human-readable diagrams/flowcharts” for “AI-readable” diagrams.

IMAGE: Deeptech Times

“We had over 400 internal documents, the HR policies and finance procurement kind of documents which we wanted to fit into an AI bot, but a lot of these have human-readable flow charts. It doesn’t read them very well. We went back to the line departments to ask them to rewrite the documents, but it is really a pain. In the end, what we came up with is we developed a GenAI tool to help improve the readability of these documents and transform the flow chart into a machine or AI readable kind of format, then feed into the AI bot.”

Starting at the top is key to rolling out AI beyond the pilot phases

For EFG, Rouam shares that it starts from the top. “I need the board and the C-suite to be on board with AI. If I don’t have their backup, it’s going to be very hard to do anything. They won’t set the right tone, so I started at the top. I did a lot of trainings at that level. Then I moved to the specialist team that I had to put together so it was risk compliance, legal, data protection. And then now we are rolling out for the whole entire group because the risk is everywhere.”

She emphasised the importance of executive support, clear principles, and agile delivery in AI implementation. She also highlighted the need for upskilling and responsible AI use to conserve the workforce.

Chua shared a public sector perspective. “At the Energy Market Authority, we sit under the corporate services umbrella division, so that actually provides central support for where my data and my transformation team will provide the expertise to line departments. What we are operating under currently is a hub-and-spoke model where we have dedicated resources to help kickstart some of this development. What we are moving into, after we build the foundation, is a decentralised model.”

“We are working very closely with EY to build the house, the platform, and the foundation thereafter to drive adoption. Then it’s about empowering and upskilling the line officers,” she said.